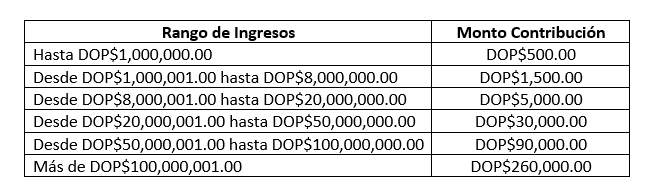

Article 36 of the Integral Management and Co-Processing of Solid Waste Law No. 255-20 establishes a special mandatory contribution, to every entity, based on its income, with the purpose of creating a fund to mitigate the negative effects of the current waste disposal and to develop an integral management system.

The contributions shall be:

- Contributions will be indexed annually according to the Central Bank’s CPI.

- Contributions may be deducted from the gross income of legal entities in accordance with the Tax Code.

- The liquidation will be made annually together with the annual affidavit of the previous fiscal year, and the amount must be paid to the DGII, which must transfer it to the National Treasury within 30 days following the collection, which in turn will transfer it to the trust created by the Law.

- The declaration and payment of this tax will be made through the Virtual Office of each taxpayer. The payment authorization will be generated automatically at the time of filing the annual tax return.

- The payment deadlines are as follows:

- Corporate Income Tax (IR2) and Non-Profit Institutions (ISFL) taxpayers no later than 120 days after their closing date.

- Taxpayers under the Simplified Tax Regime (RST) by Income (RS2) no later than the last working day of March.

- Taxpayers under the RST by Purchase Methods (RS3) no later than the last working day of March.

- Taxpayers under the RST for the Agricultural Sector (RS4) no later than the deadline for filing their tax returns.

Upon expiration of the deadlines for payment, the surcharges and interest established in the Tax Code will be applied.